How to Set Up and Use Google Pay’s New UPI Circle Feature for Family Transactions?

How to Set Up and Use Google Pay’s New UPI Circle Feature for Family Transactions?

Google Pay is set to roll out a new feature called UPI Circle, following a recent announcement from the National Payments Corporation of India (NPCI). This innovation comes after the Reserve Bank of India’s decision in August to enhance the Unified Payments Interface (UPI) system.

What is UPI Circle?

The UPI Circle feature will enable two people to share a single bank account for digital transactions. This function is aimed at helping individuals, such as elderly users, who may rely on others to manage their finances. By allowing family members or trusted contacts to handle transactions from the primary account holder’s account, UPI Circle makes financial management more flexible.

How It Works

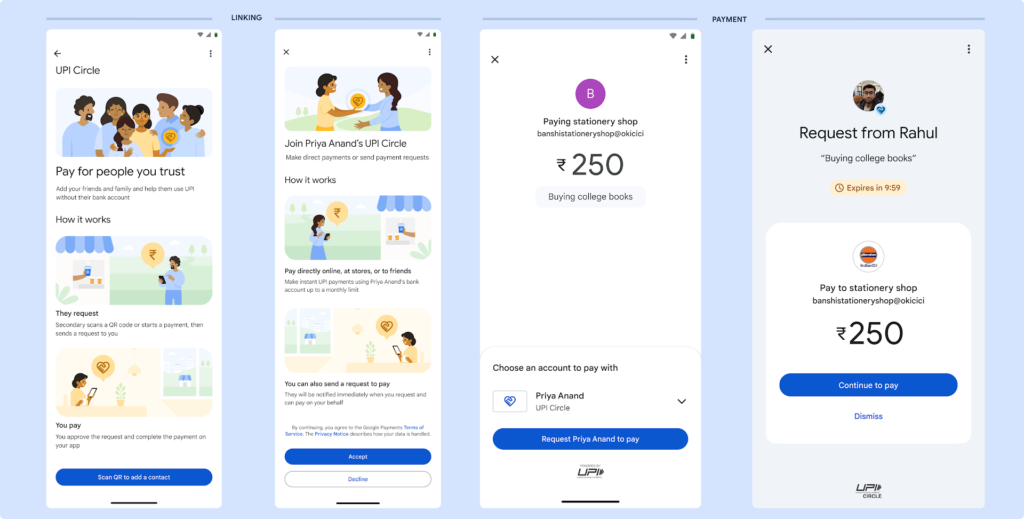

The UPI Circle setup involves a few steps:

1. Adding a Secondary User: To begin, the primary user needs to have an active bank account linked to Google Pay and save the secondary user’s mobile number in their contact list. The secondary user must have a valid UPI ID. The process starts with the secondary user generating a QR code in the Google Pay app, which the primary user then scans to add the secondary user to their UPI Circle.

2. Delegation Options: Once added, the primary user must decide between full or partial delegation:

Full Delegation: The primary user can set a monthly spending cap, up to Rs 15,000, which the secondary user can utilize without further approval. For instance, if the cap is Rs 5,000, the secondary user can make multiple payments up to this limit without needing additional permissions.

Partial Delegation: Alternatively, the primary user can review and approve each transaction individually. The primary user will receive a notification for each payment request and must approve it within 10 minutes.

3. Approval and Payments: Secondary users can initiate transactions by sending payment requests. For partial delegation, these requests need approval from the primary user, who can review and confirm the payment. With full delegation, payments within the set limit are processed without further approval.

4. Security Measures: To safeguard transactions, secondary users must have an app lock enabled on Google Pay. This adds an extra layer of security, preventing unauthorized access to the payment system.

Conclusion

The UPI Circle feature aims to make managing and sharing financial responsibilities more efficient, especially for those who need additional support with their transactions. Google Pay’s new offering promises to streamline how users handle their digital payments, making financial management easier and more secure.