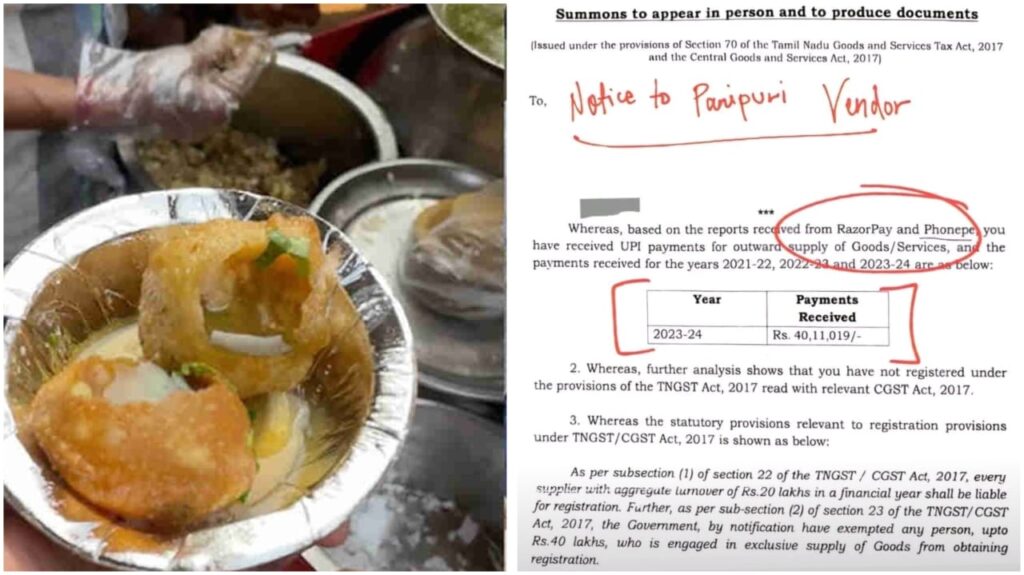

Pani Puri Seller Gets GST Notice for ₹40 Lakh Income: Social Media Reacts with ‘Career Change Ideas.

You know how parents always joke that if you fail your exams, you can just set up a stall and sell pani puri? Well, it looks like one vendor from Tamil Nadu took that advice to heart and ended up making ₹40 lakh! Recently, news has been circulating on social media about pani puri vendors receiving GST notices after crossing ₹40 lakh in transactions through online payment platforms like RazorPay and PhonePe. But it’s the amusing reactions to these notices that are stealing the show.

Pani puri wala makes 40L per year and gets an income tax notice 🤑🤑 pic.twitter.com/yotdWohZG6

— Jagdish Chaturvedi (@DrJagdishChatur) January 2, 2025

Following this news, social media has been filled with some really funny reactions.

One user quipped, “Time for him to enter capital markets: PP Waterballs,” while another playfully suggested, “Excellent export opportunities in London.” Some even joked about a “foreign collaboration.”

On a more practical note, some advised, “He should better get himself registered under GST,” while others speculated whether vendors could simply evade the system by using multiple mobile numbers and QR codes.

Are street vendors required to pay GST and income tax?

In India, street vendors are typically not obligated to pay Goods and Services Tax (GST) or income tax because they usually operate on a small scale. GST registration is only required for businesses that have an annual turnover exceeding ₹40 lakhs. Similarly, income tax applies to individuals whose annual income goes beyond the taxable threshold, which is ₹2.5 lakhs for those under 60 years old. Since many street vendors earn modest incomes, they generally fall below these limits and are thus exempt from these taxes.

Additionally, if street vendors receive payments in cash, they can often avoid falling under the tax net. However, with the rise of online payment methods that customers increasingly prefer, street vendors are becoming more noticeable to tax authorities. Reddit Link