No Need to Carry Your Phone: Proxgy Launches ThumbPay for One-Touch Payments

No Need to Carry Your Phone: Proxgy Launches ThumbPay for One-Touch Payments

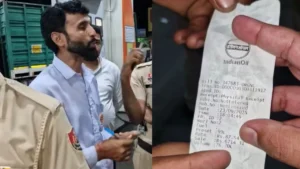

Digital payments in India are set for another breakthrough with the launch of ThumbPay, a biometric payment device introduced by IoT-based deeptech startup Proxgy. The device allows users to make transactions using only their thumb, with Aadhaar authentication directly linked to UPI. By eliminating the need for phones, wallets, or cards, ThumbPay aims to make cashless payments more accessible and universal.

How ThumbPay Works

Using the Aadhaar Enabled Payment System (AEPS), the device verifies a user’s identity when they place their thumb on the scanner. Once authenticated, the Unified Payments Interface (UPI) instantly transfers funds from the user’s Aadhaar-linked bank account. This process removes the dependency on smartphones, QR codes, or even cash, offering a fast and secure way to pay.

Pulkit Ahuja, Founder and CEO of Proxgy, explained:

“India has built world-class platforms in Aadhaar and UPI over the past decade. ThumbPay merges them into a seamless payment experience. With nothing more than their own identity, people can transact securely and conveniently.”

Features and Advantages

ThumbPay integrates biometric authentication with UPI’s real-time transfer system to create a one-touch, interoperable payment experience. Key highlights include:

- STQC-certified fingerprint scanner with liveness detection to prevent fraud

- Mini camera for extra verification and QR scanning

- UV sterilization pad for hygiene in public use

- Integrated keypad and display for optional PIN entry

- Connectivity through 4G, Wi-Fi, and LoRaWAN, ensuring functionality in low-network and rural areas

- QR, NFC, and UPI soundbox support, replacing the need for multiple devices at shop counters

Priced below ₹2,000 (around $25), ThumbPay is one of the most affordable biometric payment solutions globally. It avoids high-cost technologies like palm-vein scanners while maintaining robust security and scalability.

Accessibility and Adoption

Every Indian with an Aadhaar-linked bank account can use ThumbPay without additional registration, making it especially beneficial for elderly citizens, daily wage earners, and small merchants. The device runs on battery, making it suitable for kirana shops, street vendors, and rural markets as well as large retail outlets.

Pilot trials at select merchant locations have shown strong adoption, with customers appreciating the hassle-free payments and merchants benefiting from instant confirmations. Proxgy is now working on securing approvals from UIDAI and NPCI, with plans for a phased rollout in partnership with banks and fintech firms.

“ThumbPay is about putting the power of UPI literally at people’s fingertips,” Ahuja added.