Alert for SBI Yono Users: Rising Incidents of Fraud, Vigilance Advised

Alert for SBI Yono Users: Rising Incidents of Fraud, Vigilance Advised (representational image)

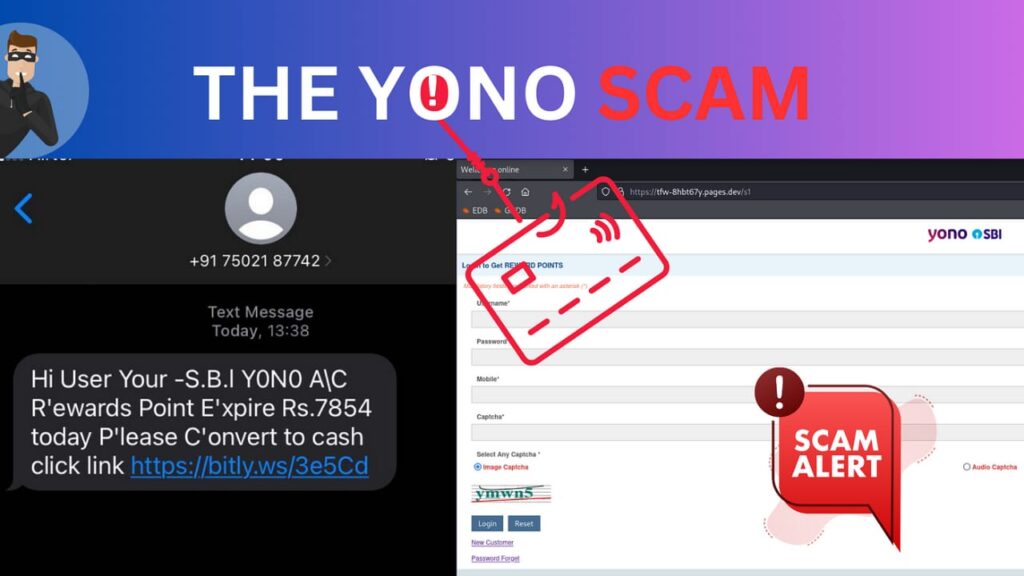

State Bank of India (SBI) YONO users are being warned to stay vigilant amidst reports of fraudulent schemes targeting unsuspecting account holders. Scammers are utilizing deceptive messages to lure users into providing sensitive personal information, potentially leading to financial losses.

The modus operandi of these scams involves enticing users with promises of claiming rewards for transactions conducted through the SBI YONO platform.

Fraudulent messages, purportedly from SBI, prompt users to click on links to redeem their rewards. Upon clicking, users are directed to a webpage resembling the legitimate SBI YONO interface, where they are prompted to enter their user ID, password, mobile number, and captcha.

• The second step asks mobile number image captcha,

• 3rd Step OTP,

• 4th Step Login Profile Password, Date of Birth,

• Same OTP again,

• The last step is the last four digits of the bank account and PAN card number and once you fill this the bank account is opened instantly

One such fraudulent message reads: “Dear Customer, Your YONO SBI REWARD Rs.8550/ will expire today, so please COLLECT [link], special for you. Real estate coin.”

It’s important for users to exercise caution and recognize the signs of these scam messages. Genuine SBI communications will never request sensitive information such as ATM card numbers, PINs, account numbers, or OTPs.

Users should refrain from clicking on suspicious links or providing personal information in response to unsolicited messages.

The rise in online scams underscores the need for increased awareness and vigilance among SBI YONO users. The bank emphasizes that rewards can be easily claimed directly through the official SBI YONO app, without the need for external links or prompts.

Furthermore, users should be aware that legitimate OTPs from SBI are valid for a limited time and are not repeatedly sent. Any message urging immediate action or threatening consequences should be treated with suspicion.

In conclusion, while SBI YONO offers convenient digital banking solutions, users must remain cautious of fraudulent schemes seeking to exploit unsuspecting individuals. By staying informed and vigilant, users can safeguard themselves against financial fraud and protect their hard-earned savings.