ITR filing starts at ₹24: JioFinance app launches tax planner and filing feature

ITR filing starts at ₹24: JioFinance app launches tax planner and filing feature

In partnership with TaxBuddy, Jio Financial Services introduces low-cost self-filing and expert-assisted options, aiming to simplify ITR filing for individuals.

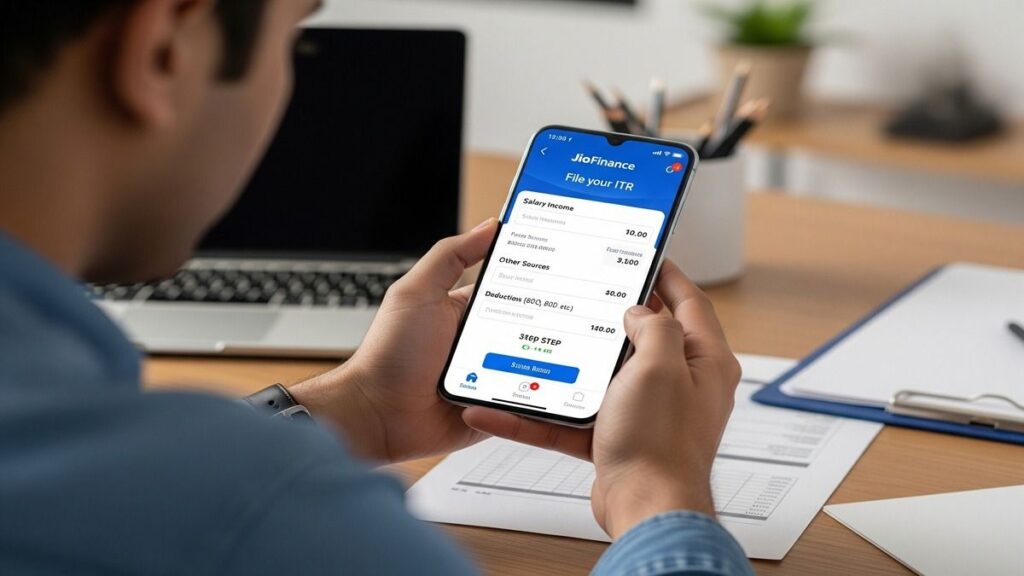

Jio Financial Services Limited (JFSL) has rolled out a tax planning and filing module on its JioFinance app, developed in collaboration with TaxBuddy. The feature offers two modes — self-service starting at ₹24 and expert-assisted filing from ₹999.

The tool is designed to help users navigate key income tax decisions, including choosing between the old and new regimes, and ensuring deductions under Sections 80C and 80D are not overlooked.

Two core features

- Tax Planner: Projects and reduces future tax liabilities through personalised deduction mapping, Housing Rent Allowance (HRA) evaluation, and tax regime comparison.

- Tax Filing: Guides users through income detail entry, document uploads, and regime selection. Post-filing, users can track return status, monitor refunds, and receive alerts for tax-related notices — all within the app.

JFSL Managing Director and CEO Hitesh Sethia said the integration aims to “remove complexity from tax filing while providing effective planning tools to manage tax liabilities year-round.”

Competitive pricing

For assessment year 2025–26, self-filing plans on most online tax platforms start between ₹199 and ₹499, while expert-assisted services range from ₹799 to over ₹2,000. Some premium packages exceed ₹3,000. By comparison, JioFinance’s ₹24 entry price undercuts most competitors.