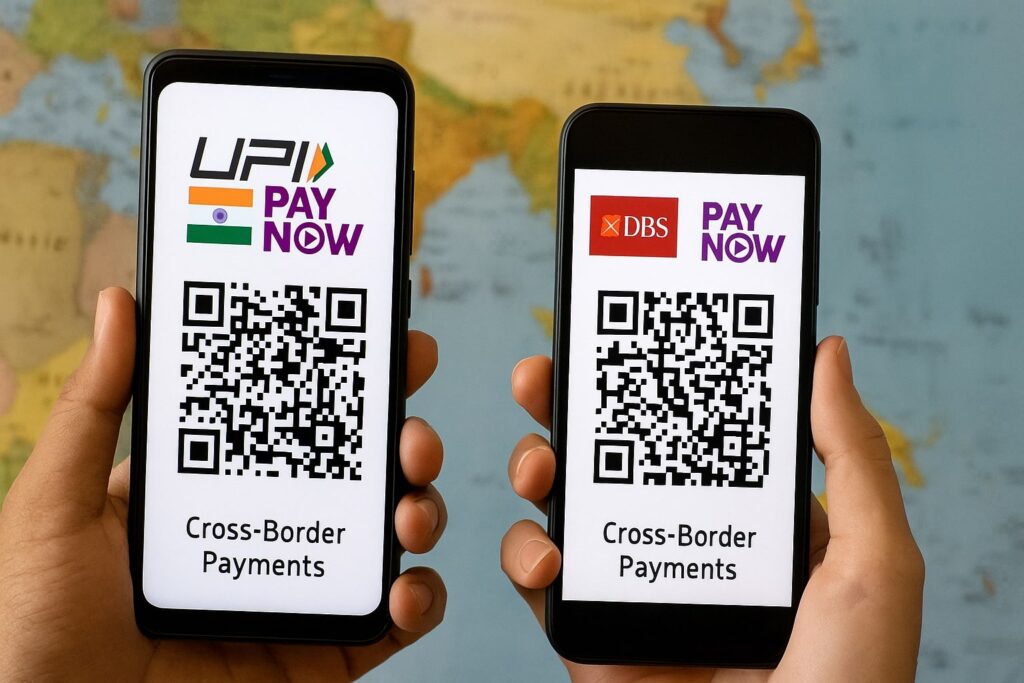

UPI-PayNow Cross-Border Remittance Expanded to 13 More Banks

UPI-PayNow Cross-Border Remittance Expanded to 13 More Banks

Indian users can now send and receive money to and from Singapore via UPI-PayNow using 19 supported banks, starting July 17, 2025.

On July 16, 2025, the National Payments Corporation of India (NPCI) announced a major expansion of the UPI-PayNow international remittance service, adding 13 more Indian banks to its roster. This move increases the total number of participating banks to 19, enabling broader accessibility for seamless fund transfers between India and Singapore.

The newly included banks are:

Bank of Baroda, Bank of India, Central Bank of India, Federal Bank, IDFC FIRST Bank, IndusInd Bank, Karur Vysya Bank, Kotak Mahindra Bank, Punjab National Bank, South Indian Bank, UCO Bank, Axis Bank, and DBS Bank India.

These join the existing group comprising Canara Bank, HDFC Bank, ICICI Bank, Indian Bank, Indian Overseas Bank, and State Bank of India.

With this development, users can now receive international remittances from Singapore into accounts with any of these 19 Indian banks through UPI-enabled apps such as BHIM, Google Pay, PhonePe, or their respective bank apps.

Outward Remittance (India to Singapore)

Currently, sending money from India to Singapore is available only through:

Canara Bank, HDFC Bank, Karur Vysya Bank, ICICI Bank, Indian Bank, Indian Overseas Bank, and SBI.

In Singapore

Users of DBS SG and Liquid Group apps can access the UPI-PayNow service to send funds to India.

The UPI-PayNow linkage allows real-time cross-border transactions, enabling the remitted amount to reflect within seconds. The system is designed with robust security protocols, ensuring reliable and safe transfers. It’s particularly ideal for small and frequent remittances, offering a cost-effective and convenient solution for international fund transfers.

This latest expansion, going live on July 17, 2025, is expected to significantly boost financial connectivity and ease of transactions between the two countries.