Zero GST List: Major Relief on Food, Healthcare, Education, and More from September 22

Zero GST List: Major Relief on Food, Healthcare, Education, and More from September 22

GST 2.0 reform cuts costs for households, reduces inflation pressure

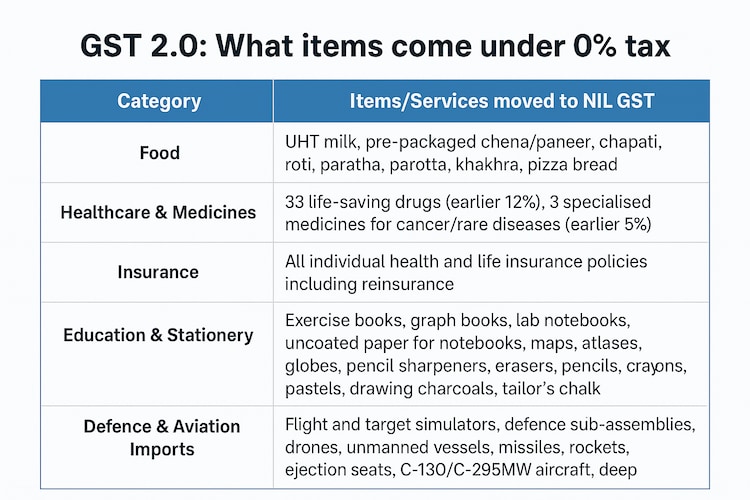

Starting September 22, the government will implement GST 2.0, bringing sweeping changes to tax rates and placing several essential goods and services under the 0% GST slab. The GST Council’s decision on September 3 abolished the earlier 12% and 28% bands, leaving only two slabs—5% and 18%.

As a result, items previously taxed at 12% have mostly shifted to 5%, while many goods in the 28% bracket have moved to 18%, lowering costs of high-ticket items like ACs, TVs, cars, and bikes. The most significant relief, however, comes from the creation of a zero GST category.

Items under Zero GST from September 22

Food & Household Essentials

- Paneer and chenna (pre-packaged and labelled)

- UHT (Ultra-High Temperature) milk

- Pizza bread, khakhra, chapati/roti

- Paratha, kulcha, and other traditional breads

Healthcare

- 33 life-saving medicines (earlier taxed at 12%)

- Three specialised medicines for cancer, rare diseases, and chronic conditions (earlier taxed at 5%)

- Medical-grade oxygen

- Health and life insurance policies (including family floater and reinsurance)

Education Supplies

- Notebooks, copies, graph and lab books

- Pencils, erasers, sharpeners

- Crayons, pastels, drawing charcoals, tailor’s chalk

- Handmade paper and paperboard

- Maps, atlases, globes, wall maps, and topographical plans

Defence and Aviation Imports

- Flight motion and target motion simulators

- Parts and sub-assemblies of missiles, rockets, drones, unmanned vessels, and military aircraft (e.g., C-130, C-295MW)

- Deep submergence vessels, sonobuoys, specialised high-performance batteries

- Technical documentation for exempted goods

- Natural cut and polished diamonds up to 25 cents (under Diamond Imprest Authorisation)

- Works of art and antiques for exhibitions

Wider Impact

This move is expected to lower household expenses, make healthcare and insurance more affordable, and boost education access by cutting costs on supplies. It will also aid defence and aviation sectors by reducing import costs, while easing inflation pressure across the economy.