Zomato and Swiggy Users Face Higher Bills as Rain Fee Now Comes With GST; Social Media Reacts With Humor and Frustration

Zomato and Swiggy Users Face Higher Bills as Rain Fee Now Comes With GST; Social Media Reacts With Humor and Frustration

Online food delivery just got a little more expensive. Starting September 22, charges on platforms like Zomato and Swiggy, including rain fees, are subject to 18% Goods and Services Tax (GST). This comes as part of a broader reform by the GST Council, which is now impacting the final bill customers pay. Social media users have been quick to voice their reactions, often in a humorous tone. One X (formerly Twitter) user joked, “After the new GST reforms, even Lord Indra is under the tax net. When it rains, you pay Rs 25 Rain Fee + 18% GST = Rs 29.50. Next: Sunlight Convenience Fee, Oxygen Maintenance Charge GST on Breathing, Pay as you inhale.”

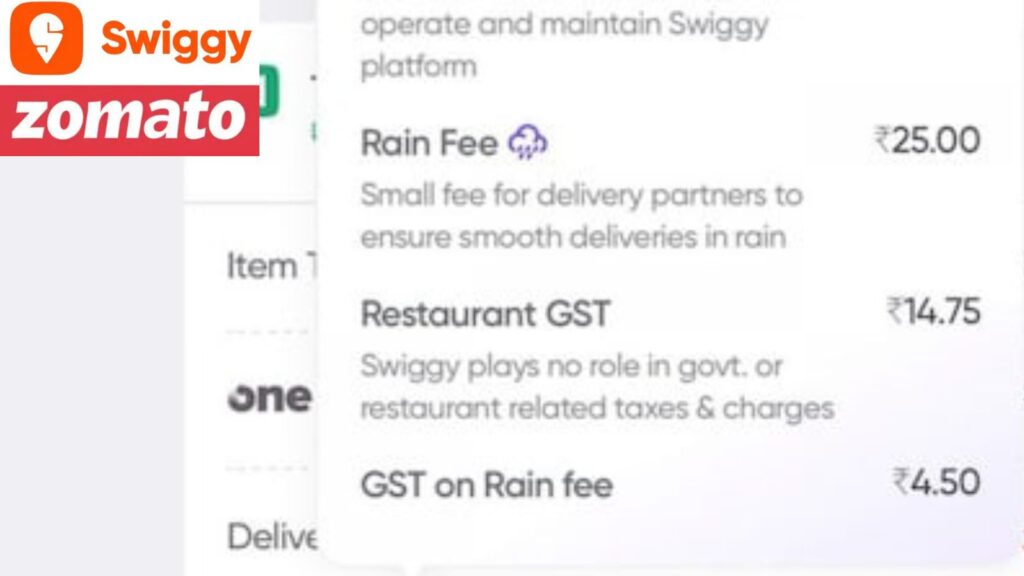

The post included a screenshot of a typical online order breakdown: Restaurant GST at Rs 14.75, rain delivery fee of Rs 25 plus Rs 4.50 GST, restaurant packaging at Rs 20, and platform fee at Rs 14.99. It quickly went viral, garnering over one lakh views and a flood of witty responses.

One user humorously added, “Next, we’ll get charged for Calling bell fee, Petrol/diesel/gas fee, Riders’ vehicle EMI fee, Potholes avoidance fee, and Traffic wait fee.” Another chimed in with, “Soon there will be a ‘Smiling Tax’ for happiness and a ‘Blink Charge’ for every eye blink.”

Some users expressed concern over the rationale behind these charges. One wrote, “How does an Rs 25 delivery charge guarantee smooth delivery by the executive? And when was GST applied to the rain fee? If it is meant for the delivery executive, why is GST being charged?”

After historic GST reforms, even Lord Indra has been brought under the tax net.

— Ashish Gupta (@AshishGupta325) September 22, 2025

Now when it rains, you get ₹25 Rain Fee + 18% GST = ₹29.50 😂

Next up:

👉Sunlight Convenience Fee 🌞

👉Oxygen Maintenance Charge 💨

👉GST on Breathing, Pay as you inhale pic.twitter.com/JdtHfr715G

Meanwhile, others suggested simpler alternatives. “Pick up the phone and call your local Kirana store. He still delivers for free. What kind of people are you guys? Khudka koi dimaag hai bhi ki nahi? (Do you even have any common sense?),” remarked one frustrated user.

Another comment defended delivery personnel, saying, “Delivery partners deserve the rain fees. But I cannot comment on who should pay the fee.” A separate point raised questions about GST applicability: “Amounts paid directly to gig-workers don’t fall under GST. It seems Zomato is collecting this amount, so GST applies. The company should clarify who actually receives this money.”

The reason behind the increase in food delivery bills is tied to a change in GST rules for e-commerce platforms. The GST Council has now classified local e-commerce delivery services under section 9(5) of the Central GST Act. This means that electronic commerce operators (ECOs) like Zomato and Swiggy must pay GST on delivery services they provide, even if they are not directly supplying the service.

Previously, delivery charges were often considered “pass-through” payments to delivery partners, with inconsistent GST treatment. Under the new rules, every delivery fee now attracts 18% GST.

For context, Morgan Stanley cited that Zomato’s average delivery fee in fiscal 2025 was around Rs 11-12, adding roughly Rs 2 in GST. Swiggy, with an average fee of Rs 14.5, now adds about Rs 2.6 in tax. Quick-commerce platforms like Blinkit had already taxed delivery charges, so their users see no significant change, while Swiggy Instamart, with a lower fee of Rs 4, adds approximately Rs 0.8 in GST.