Cost of Living in Mumbai: How Much You Need to Earn for a Quality Lifestyle

Living in Mumbai: Cost of Living Insights and Salary Expectations in 2025

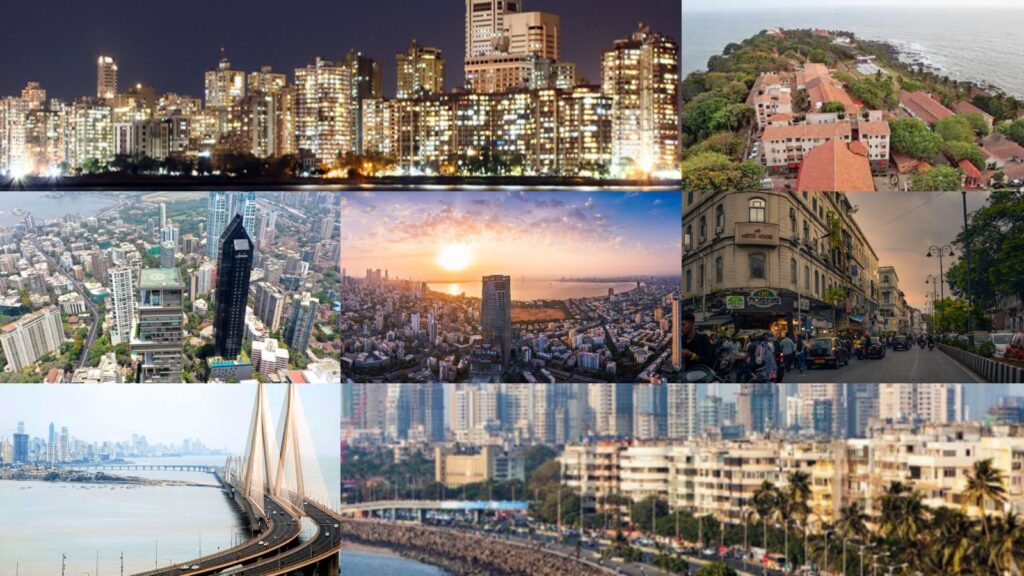

Mumbai, January 2025 – Known as the “city of dreams,” Mumbai continues to attract thousands of people every year, offering a wealth of opportunities in commerce, trade, and creative industries. However, being the financial capital of India has also made Mumbai one of the most expensive cities to live in, with high living costs driven by soaring property prices, expensive rent, and rising healthcare expenses.

To help prospective residents understand the cost of living in Mumbai, ET Online, in collaboration with AVSAR, a recruitment consultancy, analyzed the income requirements for a comfortable lifestyle in this bustling metropolis. The analysis covers salaries across different job roles, monthly expenses, transportation, rent, and utility costs, providing insights for those considering a move to the city.

Transportation Costs: Commuting in Mumbai

Getting around Mumbai can be costly, but the public transport system offers a variety of options for daily commuters:

- Western Suburbs (Andheri, Bandra, Juhu):

- Monthly train fare (2nd class): Rs 500 – Rs 1,200

- Auto rickshaw fares: Rs 2,000 – Rs 4,000

- Uber/Ola rides: Costs can vary based on distance and time of travel.

- South Mumbai (Colaba, Marine Drive, Worli):

- Monthly train pass: Rs 600 – Rs 1,500

- Auto fares/cab rides: Rs 3,000 – Rs 5,000

- Navi Mumbai & Thane:

- Monthly train expenses: Rs 400 – Rs 1,000

- Longer commutes can push costs to Rs 1,500 – Rs 3,000 per month.

Eating Out and Everyday Meals: Dining in Mumbai

Food costs also vary across the city:

- Western Suburbs:

- Mid-range restaurant meals: Rs 300 – Rs 500 per meal

- Monthly dining-out expenses: Rs 10,000 – Rs 12,000.

- South Mumbai:

- Mid-range restaurant meals: Rs 500 – Rs 800 per meal

- Monthly dining-out expenses: Rs 12,000 – Rs 15,000.

- Navi Mumbai & Thane:

- Daily meals: Rs 200 – Rs 400

- Monthly dining expenses: Rs 8,000 – Rs 10,000.

Rent Estimates: Housing Costs in Mumbai

Renting a place in Mumbai can be costly, especially in prime locations:

- Western Suburbs:

- 1 BHK apartment: Rs 35,000 – Rs 50,000 per month

- 2 BHK apartment: Rs 60,000 – Rs 1,00,000 per month.

- South Mumbai:

- 1 BHK apartment: Rs 50,000 – Rs 1,00,000 per month

- 2 BHK apartment: Rs 1,00,000 – Rs 2,50,000 per month.

- Navi Mumbai & Thane:

- 1 BHK apartment: Rs 15,000 – Rs 30,000 per month

- 2 BHK apartment: Rs 30,000 – Rs 60,000 per month.

Other Living Costs: Utilities, Entertainment, and More

In addition to rent, utilities and entertainment are significant aspects of living expenses:

- Utilities (electricity, water, gas): Rs 3,000 – Rs 6,000 per month for a 1-2 BHK apartment.

- Internet costs: Rs 700 – Rs 1,500 per month.

- Gym memberships: Rs 1,500 – Rs 4,000 per month.

- Movies and entertainment: Ticket prices range from Rs 200 – Rs 500.

Average Salary Expectations in Mumbai (2025)

Salaries in Mumbai vary greatly depending on experience, industry, and location:

- Freshers (0-2 years of experience):

- Western Suburbs: Rs 3,00,000 – Rs 5,00,000 per annum

- South Mumbai: Rs 4,00,000 – Rs 6,00,000 per annum

- Navi Mumbai & Thane: Rs 2,50,000 – Rs 4,50,000 per annum.

- Mid-Level Professionals (5-10 years of experience):

- Western Suburbs: Rs 8,00,000 – Rs 12,00,000 per annum

- South Mumbai: Rs 10,00,000 – Rs 15,00,000 per annum

- Navi Mumbai & Thane: Rs 7,00,000 – Rs 10,00,000 per annum.

- Senior Professionals (10+ years of experience):

- Western Suburbs: Rs 20,00,000 – Rs 30,00,000 per annum

- South Mumbai: Rs 25,00,000 – Rs 40,00,000 per annum

- Navi Mumbai & Thane: Rs 15,00,000 – Rs 25,00,000 per annum.

Case Studies: Living in Powai, Mumbai

Based on the survey, here’s a snapshot of the living expenses of different professionals:

- Teacher (Salary: Rs 40,000 – Rs 50,000 per month):

- Monthly expenses (utilities & medical visits): Rs 30,000 + Rs 1,500

- Likely owns home, no rent.

- Senior Consultant (Salary: Rs 4,00,000 per month):

- Monthly utilities: Rs 25,000 – Rs 30,000

- Owns home, so no rent.

- Corporate Chef (Salary: Rs 1,50,000 per month):

- Monthly utilities (housing, transportation, leisure): Rs 1,00,000

- High percentage of income spent on living expenses.

- Procurement Manager (Salary: Rs 14,00,000 per annum):

- Monthly utilities: Rs 65,000

- ERP Consultant (Salary: Rs 9,00,000 per annum):

- Monthly utilities: Rs 30,000 – Rs 35,000

- Comfortable lifestyle.

- GM in Procurement (Salary: Rs 20,00,000 per annum):

- Monthly utilities: Rs 50,000

- Balance between income and expenses.

Mumbai: A City of Opportunities, But at a Cost

While Mumbai remains a hub of opportunity, the high cost of living presents a challenge for many. Despite the expensive lifestyle, the city continues to attract professionals seeking career growth and lifestyle enhancement. According to the survey, 10 out of 14 professionals expressed a desire to continue living in Mumbai, highlighting the city’s allure despite its hefty price tag.