ICICI Bank Takes Swift Action: Blocks 17,000 Credit Cards Following Data Breach

ICICI Bank Takes Swift Action: Blocks 17,000 Credit Cards Following Data Breach

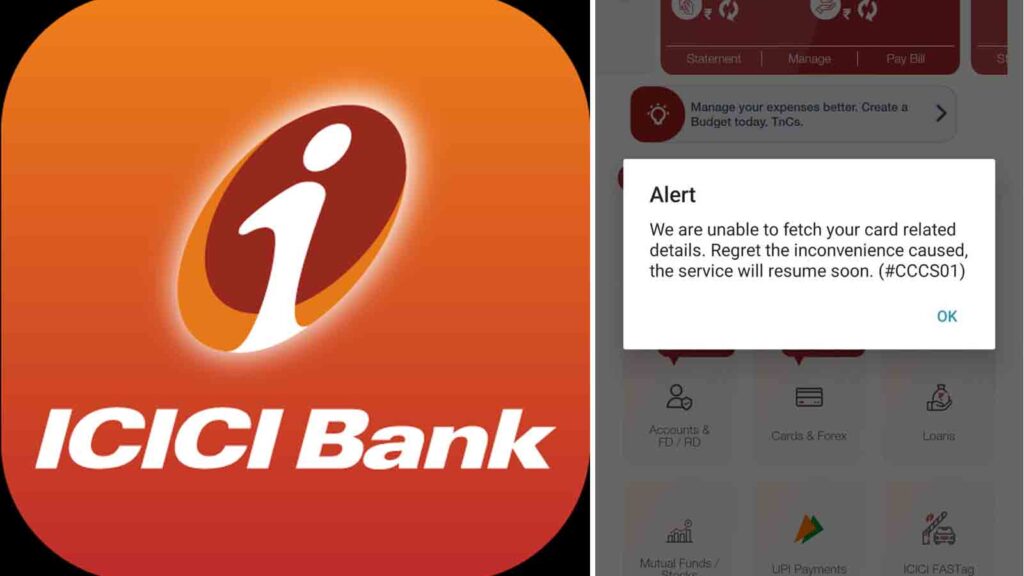

ICICI Bank, one of India’s leading financial institutions, has taken decisive action by blocking 17,000 credit cards after a technical glitch in its mobile banking application, ‘iMobile,’ exposed users to the risk of viewing other customers’ card details. This breach, which affected about 0.1 percent of the bank’s credit card portfolio, prompted swift responses from both the bank and concerned users.

Reports indicate that the glitch caused newly issued credit cards to be erroneously linked with existing customers’ accounts, allowing unintended access to sensitive information such as card numbers, expiration dates, and CVVs. Users also discovered the ability to modify settings associated with these cards, such as enabling foreign transactions or adjusting spending limits.

I just checked my imobile app. Card detail is locked by ICICI bank as this news may be true. Serious security lapse.#ccgeek #creditcard https://t.co/4HWABRRpPj pic.twitter.com/yYEV39kgBt

— CredoLite💳 (@Credolite) April 25, 2024

In response to the situation, ICICI Bank acknowledged the issue, attributing it to a misalignment of new credit cards in the digital channels. The bank swiftly rectified the error, emphasizing that there had been no reported instances of misuse of the affected cards. Furthermore, ICICI Bank assured customers of compensation for any financial losses incurred as a result of the incident.

Following the discovery of the breach, customers took to social media platforms to voice their concerns and share their experiences. Experts advised affected users to promptly flag any anomalies observed with their cards and take precautionary measures, such as blocking and replacing them through the bank.

This incident underscores the critical importance of robust security protocols and checks and balances in safeguarding customer data within the banking sector. The swift response from ICICI Bank highlights its commitment to addressing such issues promptly and ensuring the security and trust of its customers.

The revelation of the data breach at ICICI Bank comes shortly after the Reserve Bank of India’s crackdown on Kotak Mahindra Bank for similar concerns regarding IT security and compliance. The regulatory actions underscore the imperative for banks to maintain rigorous standards in safeguarding customer information and addressing vulnerabilities in their digital infrastructure.