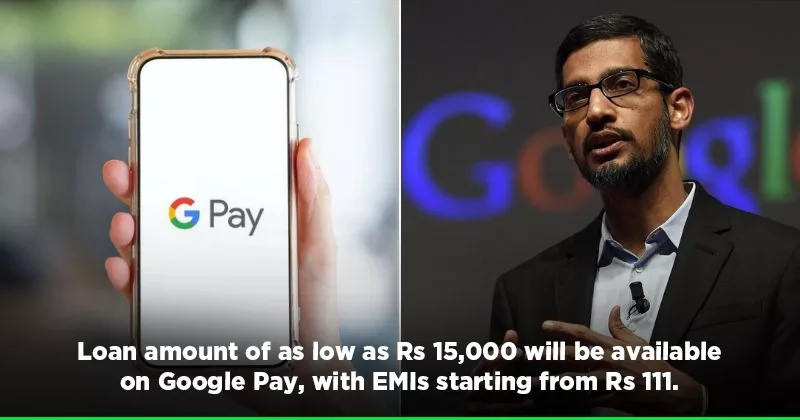

Google to provide sachet loans on Google Pay App

Google to provide sachet loans on Google Pay App

By: Pune Pulse

October 20, 2023

Following the conclusion of the COVID crisis, the country has embraced digitization, leading to a significant increase in mobile payments.

Prominent mobile payment applications such as Paytm, Google Pay, and PhonePe have gained popularity, allowing individuals to both receive and transfer funds.

These applications enable users to send money ranging from one rupee to one lakh, subject to the respective bank’s transaction limits.

Among these applications, Google Pay has introduced a loan option to cater to the needs of the people. This initiative eliminates the necessity of approaching traditional banks for small loans. Google Pay has collaborated with various Indian banks and financial institutions to facilitate this service.

The company will provide sachet loans, starting from Rs 15,000, to support small traders, with monthly installments commencing at Rs 111. Google Pay has partnered with DMI Finance to extend sachet loans.

Furthermore, Google Pay has joined forces with ePayLater to offer credit to merchants, aiming to fulfill their working capital requirements. Additionally, Google has established a credit line on UPI in collaboration with ICICI Bank.

Simultaneously, the company has partnered with Axis Bank to expand its personal loan portfolio. By extending loans to small merchants, Google aims to tap into India’s financial markets. Presently, prominent payment companies like Paytm and BharatPe are already providing similar services to merchants.

Sachet loans are small loans that have a short repayment period. Typically, these loans are pre-approved and can be obtained immediately. Repayment is also convenient. The loan amounts start at Rs 10,000 and can range from 7 to 12 months. To acquire a sachet loan, it is necessary to download the loan application.

In September last year, the Reserve Bank of India (RBI) permitted the linkage of RuPay credit cards with UPI. The objective of the RBI is to encourage the utilization of low-cost loans through the UPI network.

During the Global Fintech Fest held last month in September, RBI Governor Shaktikanta Das announced the introduction of a credit line for UPI. This initiative will facilitate banks and borrowers in offering credit lines on UPI accounts, which customers can utilize for their purchases.

Madhupriya Dhanwate