Mutual Fund investors must redo KYC by March 31 or risk transaction freeze; Here’s what you need to know

Representational pic

The looming deadline of March 31, 2024, for mutual fund investors to re-do their KYC (Know Your Customer) has prompted a flurry of communications from Registrar and Transfer Agents (RTAs) such as CAMS and KFint Technologies. The emails, addressed to mutual fund distributors (MFDs), emphasize the necessity for investors to update their KYC based on “officially valid documents.”

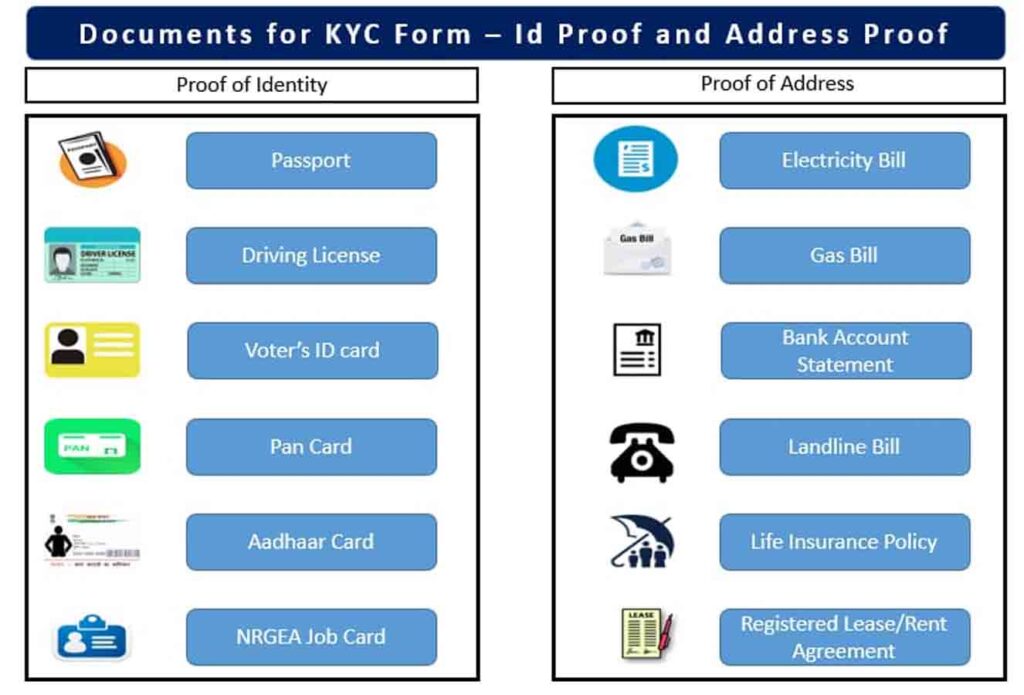

Investors whose KYC is not grounded in officially recognized documents like Aadhaar card, passport, or voter ID card are required to complete the re-KYC process before the deadline. Failure to do so could result in investors being unable to conduct any mutual fund transactions, including SIPs, SWPs, or redemptions, from April 1, 2024.

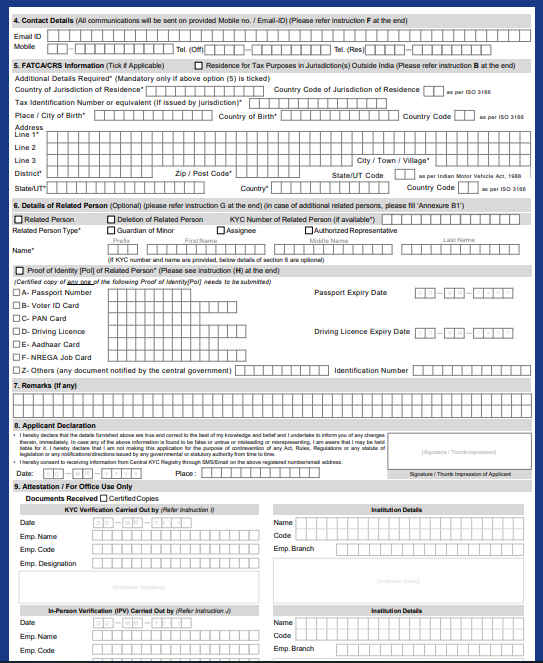

The process for re-KYC entails submitting a physical KYC form along with relevant documents to either mutual fund houses or RTAs.

Do you need re-KYC: Before you go ahead with updating your KYC, you first need to know whether it’s needed. This will depend on whether you had submitted an officially valid document when you first did KYC for your MF investments.

Now, some investors may clearly remember the ID proof they used for this purpose. If not, you can go to the CVL KRA website to check this.

No uniform list of officially valid documents: Leaving aside the deadline, what may be a source of some confusion is the list of the officially valid documents itself.

Once updated, this information is relayed to KYC registration agencies (KRAs), ensuring alignment across all mutual fund investments under the investor’s PAN.

However, challenges and concerns loom over the re-KYC process. Investors may face difficulties completing re-KYC before the deadline due to the physical submission requirement and potential delays in processing. Additionally, discrepancies between the lists of officially valid documents provided by different RTAs could sow confusion among investors.

Moreover, the urgency of action cannot be overstated, as the completion of re-KYC before the deadline is paramount to avoiding transaction freezes after March 31, 2024. Despite potential delays, the completion of re-KYC will enable investors to resume mutual fund transactions once the process is finalized.

Crucially, investors must ensure their PAN is linked with Aadhaar to circumvent KYC issues. Failure to link PAN and Aadhaar may result in the investor’s PAN being unrecognized by mutual fund houses. Therefore, prompt action is urged, and investors are encouraged to initiate the re-KYC process promptly to avoid disruptions to their investment activities and maintain regulatory compliance.

Seeking guidance from mutual fund houses or RTAs and staying informed throughout the process will be instrumental in navigating the re-KYC requirements effectively.