Pune Municipal Corporation’s Revenue Takes a Hit as Property Tax Collection Suspended in Merged Villages

Pune Municipal Corporation's Revenue Takes a Hit as Property Tax Collection Suspended in Merged Villages (pic for represantational purpose only)

In the fiscal year 2023-24, Pune Municipal Corporation (PMC) set its sights on gathering ₹ 2,400 crores, encompassing property tax from villages and outstanding dues. However, falling short of this target, the civic body has only managed to amass ₹2,153 crores thus far.

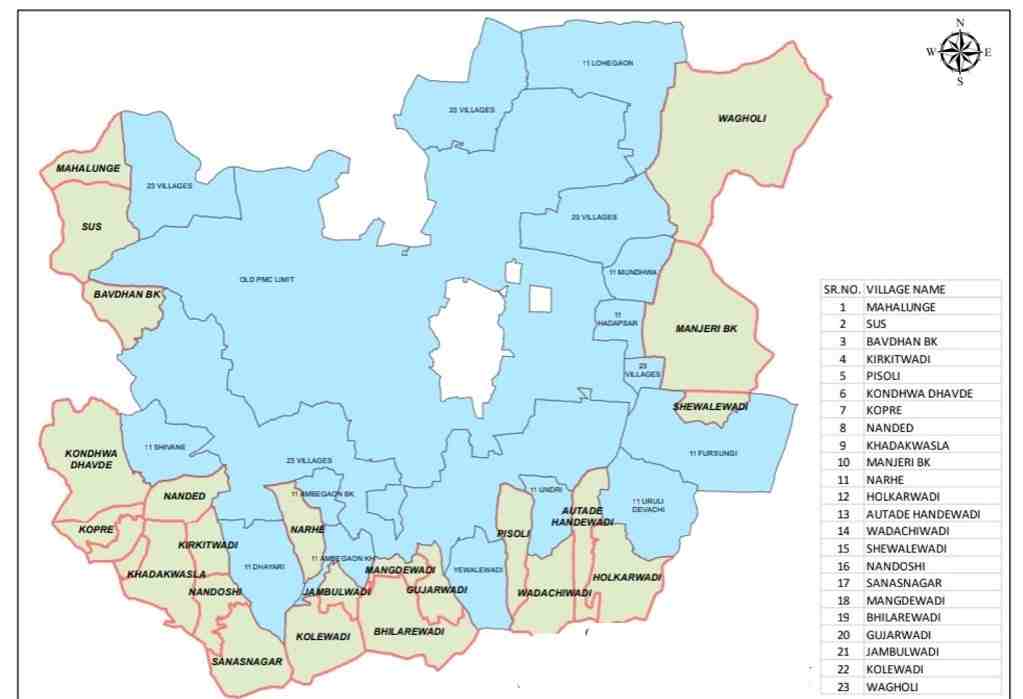

The suspension of property tax arrears collection in 34 villages under the PMC jurisdiction, as per the state government’s directive, has dealt a significant blow to the civic body’s finances.

PMC officials highlight the pressing need to retrieve ₹1,246 crore in property tax from these merged areas. While appeals have been made to property tax holders to settle their outstanding dues, projections suggest an expected inflow of around ₹100 crore by March 31.

Efforts to seal properties of defaulters were initiated by the city administration, albeit temporarily halted in compliance with state government directives preceding the imposition of Lok Sabha election code of conduct.

PMC data underscores the vast scale of the challenge, with approximately 4.25 lakh properties in these areas, of which 3.75 lakh are included in the tax net. A targeted collection of about ₹985 crore from 11 areas and ₹261 crore from 23 villages is imperative.

Currently, PMC imposes a two per cent penalty per month on property tax arrears, escalating to over 24 per cent annually. Consequently, the outstanding property tax of the 34 merged villages has surpassed the ₹1,000 crore mark, underscoring the severity of the fiscal shortfall.